Unlocking Financial Freedom: Strategies to Eliminate Debt Quickly

Debt can feel like a heavy chain around your financial potential, inhibiting you from reaching personal and economic growth. However, with the right strategies and tools, eliminating debt and stepping into financial freedom is entirely achievable. In this in-depth article, you will discover effective methods to pay off debt quickly, enhancing your financial health and paving the way to a debt-free life.

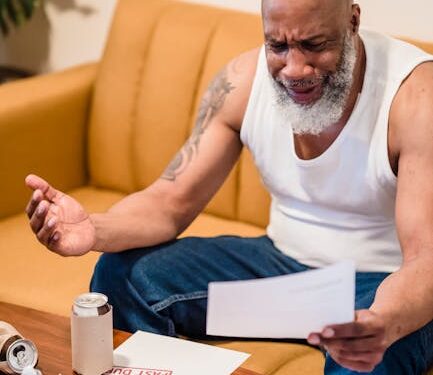

Understanding the Impact of Debt

Before diving into debt elimination strategies, it’s crucial to grasp the impact of debt on your financial health. Debt can affect your credit score, limit your investment opportunities, and increase your financial stress. Recognizing the types of debt you hold and their implications is the first step towards developing a plan to eliminate them.

Types of Debt

- Secured Debt: Includes mortgages and car loans, which are backed by collateral.

- Unsecured Debt: Encompasses credit cards and personal loans, which are not backed by collateral but often carry higher interest rates.

Strategic Planning to Eliminate Debt

Effective debt elimination begins with strategic planning and setting realistic goals. Here’s how you can create a fitting strategy:

1. Assess Your Financial Situation

Start by listing all your debts, including the owed amounts, interest rates, and monthly payments. This comprehensive overview is crucial in prioritizing which debts to pay off first.

2. Budgeting for Debt Repayment

Create a budget that prioritizes debt repayment. Allocate a portion of your income to debt elimination, ensuring that other essentials like housing, utilities, and food are covered. Financial software or a simple spreadsheet can be instrumental in managing your budget efficiently.

3. Setting Smart Financial Goals

Setting S.M.A.R.T (Specific, Measurable, Achievable, Relevant, Time-bound) goals is essential for progress. For instance, aim to pay off $2,000 from your credit card debt over the next year by increasing your monthly payment by $170.

Debt Reduction Techniques

Once your plan is in place, employ these effective debt reduction strategies to expedite your journey to financial freedom:

The Snowball Method

This method involves paying off debts from the smallest to largest balances, regardless of interest rates. The psychological wins of clearing smaller debts quickly can motivate you to tackle larger debts with more vigor.

The Avalanche Method

Contrary to the Snowball method, the Avalanche method prioritizes debts with the highest interest rates first, potentially saving you more money on interest over time.

Debt Consolidation

This strategy involves combining multiple debts into a single, larger debt with a lower interest rate, making it easier to manage payments and possibly reducing the debt repayment period.

Leveraging Resources for Debt Elimination

There are several resources and tools you can utilize to enhance your debt repayment efforts:

Credit Counseling Services

Seeking guidance from professional credit counselors can provide personalized advice tailored to your financial situation.

Debt Management Plans

A debt management plan (DMP) can help you consolidate payments and possibly reduce interest rates and penalties.

Financial Management Apps

Apps like Mint or You Need a Budget (YNAB) can help track your spending and manage budgets effectively.

Maintaining Financial Discipline

Staying disciplined is key to eliminating debt and achieving financial freedom. Avoid taking new loans or credit lines that can further increase your debt burden. Regularly review and adjust your budget to improve your financial strategies and stay on target with your goals.

Conclusion

While eliminating debt quickly requires commitment and careful planning, achieving financial freedom is worth the effort. By understanding the implications of debt, strategically tackling repayment, and leveraging available resources, you can effectively manage and eliminate your debt, setting a solid foundation for a financially secure future.

Remember, every step taken towards minimizing debt is a step towards enhanced financial freedom. Start implementing these strategies today and seize the control over your financial destiny.